But if you prefer CIF,the procedures is as following:

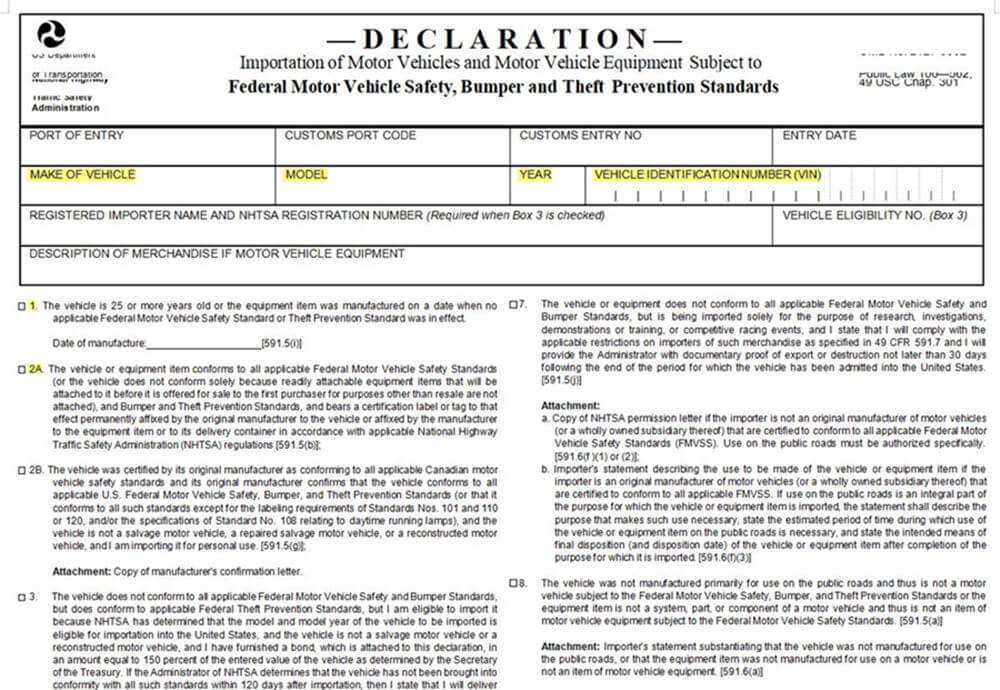

1. Prepare and fill DOT in advance,and submit to the US customs.

DOT is essential for every trailer importer. ETO DEVICE has obtained that in 2022,which is the first manufacturer who got this. If you plan to import a food trailer, please make sure that your supplier is registered with NHTSA as a manufacturer under 49 CFR 566 and 49 CFR Part 551. Click to check our DOT information.

DOT format is like this. Feel free to ask the format from Etodevice.

2. Sent all customs clearances paper including commercial invoice, packing list,BL to US customs in advance before ship arrival.

3. Paying for taxes, customs clearances fees and any other expenses incurred at the port .

(The food trailer taxes rate is 25.4714%, which is charged according to the good value, excluding shipping freight)

4. Receiving Goods Pickup notice from shipping company,and pick your trailer up there.

If you prefer CIF incoterms, it is better to ask your agent to contact us in advance, so that we can submit him the papers, then he can check whether he can help you pick goods up.

Because every agent has different ability.

We expect all customers can receive their dream trailer, and begin the mobile business soon ! Browse our more food trailers now.

Any more questions feel free to contact us.